Value added tax calculation

Duly issued Certificate of Creditable VAT Withheld at Source BIR Form 2307 if applicableSummary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at Source SAWT if. EU VAT frequently asked questions.

Differentiate Between Vat And Sales Tax In 2022 Sales Tax Differentiation Tax

A value-added tax VAT is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at the point of retail sale.

. 5 of Act 61 of 1993 PART VII REPRESENTATIVE VENDORS 46 Persons acting in a representative capacity 47 Power to appoint agent. Economic Value Added EVA for the year 2016 Net Operating Profit After Tax Capital Invested. In corporate finance as part of fundamental analysis economic value added is an estimate of a firms economic profit or the value created in excess of the required return of the companys shareholdersEVA is the net profit less the capital charge for raising the firms capital.

Want Amazon to handle VAT. When tax due and payable. Value Added Tax payable 10 x IDR 25000000 IDR 2500000.

Check Calculation of VAT VAT Rates VAT Registration Documents Required and Process of VAT Collection. HST tax calculation or the Harmonized Sales Tax calculator of 2022 including GST Canadian government and provincial sales tax PST for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador. EBITDA is one indicator of a companys.

Tax authorities may assess VAT tax base at a market value of transaction if it turns out that the relationship affected the calculation of the remuneration for the supply of goods or provision of services and one party to the transaction is a taxpayer not eligible. Deductible input tax for mixed taxable and exempt supply. Comptroller to collect tax.

The Value Added Tax VAT is calculated directly on the sale price of the product service concerned. The merchant in this case will keep 1500. 99-189 added definitions of omitted property books papers documents and other records and designee of an assessor replaced authority to conduct hearings with authority for audits listed who can perform audits required.

EBITDA - Earnings Before Interest Taxes Depreciation and Amortization. PART 4 TAX ON SUPPLY DIVISION 1THE TAX 14. Value of imported goods.

Calculation of tax payable and refunds. Value-added tax 67A Application of increased or reduced tax rate. Businesses collect and account for the tax on behalf of the government.

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. The cost of interest is included in the finance charge WACCcapital that is deducted from NOPAT in the EVA calculation and can be approached in two ways. To report the calculation of the amount of tax both for reporting Pajak Pertambahan Nilai PPN VAT and luxury sales tax PPnBM payable SPT Masa VAT is a form that is used by corporate taxpayers.

This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property. Its a tax that VAT-registered traders in Europe add to the price of the goods they sell and pass on to the national tax authorities when they file their tax returns. Tax payable for tax period 48.

Deductible input tax 49. Value-Added Tax - VAT. 45A Calculation of interest payable under this Act S.

Value-added tax is a common form of indirect tax levied on services and goodsLearn about VAT Calculation features VAT registration and VAT rates in India. Economic Value Added EVA shows that real value creation occurs when projects earn rates of return above their cost of capital and this increases value for shareholders. 8- Calculation of PROTAX-KSA payable.

636a as added by section 1102. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. For instance if the cost of a product is 1500 and the percentage at which VAT is charged is 10.

The idea is that value is created when the return on the firms economic capital employed exceeds the. We welcome your comments about this publication and suggestions for future editions. NW IR-6526 Washington DC 20224.

A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. A VAT of 5 per cent is levied at the point of sale. Examples of methods commonly used in Step 1 are the Relief from.

Learn how to register for VAT value added tax and how to file VAT returns in the UAE. 4 Economic Value Added EVA Calculation. IMPOSITION OF THE TAX 6.

Where the cash flows do not reflect amortisation charges in the tax calculation. From the above we have all three factors ready for Economic Value Added calculation for 2016 and 2015. Refund on overpayments of tax on imports.

Polish regulations on Value Added Tax VAT are based on the EU legislation. D to replace board of tax review with board of assessment appeals effective July 6 1995. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

Value Added tax calculator UK. Repealed by Act No. The consumer will pay 1650.

Quarterly Value-Added Tax Return. Value-added tax is charged as a percentage of the total cost of a product. A property tax or millage rate is an ad valorem tax on the value of a property.

There is imposed by this Act a tax to be known as the value added tax which is to be charged on the a supply of goods or services made in the country other than exempt goods or. As an entrepreneur you must therefore know the valid VAT rate for your activity and mention on your invoice. The tax is levied by the governing authority of the jurisdiction in which the property is located.

VAT stands for Value Added Tax. Value Added Tax Vat In Saudi Arabia governments the new law that the VAT rate was increased by the government 5 is the old rate 15 8775 Prince Abdulaziz Bin Musaid Bin Jalawi Al-Sulaimaniyah Dist Unit Number. All about Value added Tax VAT in India.

Reverse Value Added tax calculator UK 2020. Often a property tax is levied on real estate. EBITDA stands for earnings before interest taxes depreciation and amortization.

45A inserted by s. The remaining amount ie 150 will be paid to the government. Value Added Tax or VAT is a tax on the consumption or use of goods and services.

Learn more about VAT Services. 54 Riyadh 12234 2949 Kingdom of Saudi Arabia. Value Added tax calculator UK 2020.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. PART 3 TAX ON IMPORTS 9. Calculation of VAT from the net price The calculation of the VAT amount based on the price excluding VAT is calculated as follows.

2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a. 2550Q - Quarterly Value-Added Tax Return February 2007 ENCS. The TAB is added to the value of the intangible asset on the premise that a potential purchaser will be willing to pay an amount that reflects the present value of the tax amortisation benefit.

Automatic Tax Calculation Tax Creative Professional Accounting

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

Download Revenue Per Employee Calculator Excel Template Exceldatapro Excel Shortcuts Metric Excel Templates

How To Calculate Vat In The Kingdom Of Saudi Arabia Vat In Uae Goods And Services Registration

Vat Vs Gst Infographic Simple Flow Chart Infographic Goods And Services

Vat Registration Threshold Calculation In Uae Vat Consultants In Dubai Uae Tax Debt Indirect Tax Seo

Sa302 Tax Calculation Request Form Self Assessment Tax Request

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Value Added Tax Vat Infographic Value Added Tax Ads Tax

Pin By Rajesh Doye On Gst India Goods And Services Tax General Knowledge Book Government Lessons Accounting And Finance

Understanding The Benefits Of Hiring Vat Compliance Services In Dubai Bookkeeping Services Payroll Software Accounting Services

Value Added Tax Explained What Is Vat And How To Calculate It Place Card Holders Value Added Tax Add Tax

Accounting Services In Dubai And Audit Services In Dubai Accounting Services Audit Services Accounting Firms

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

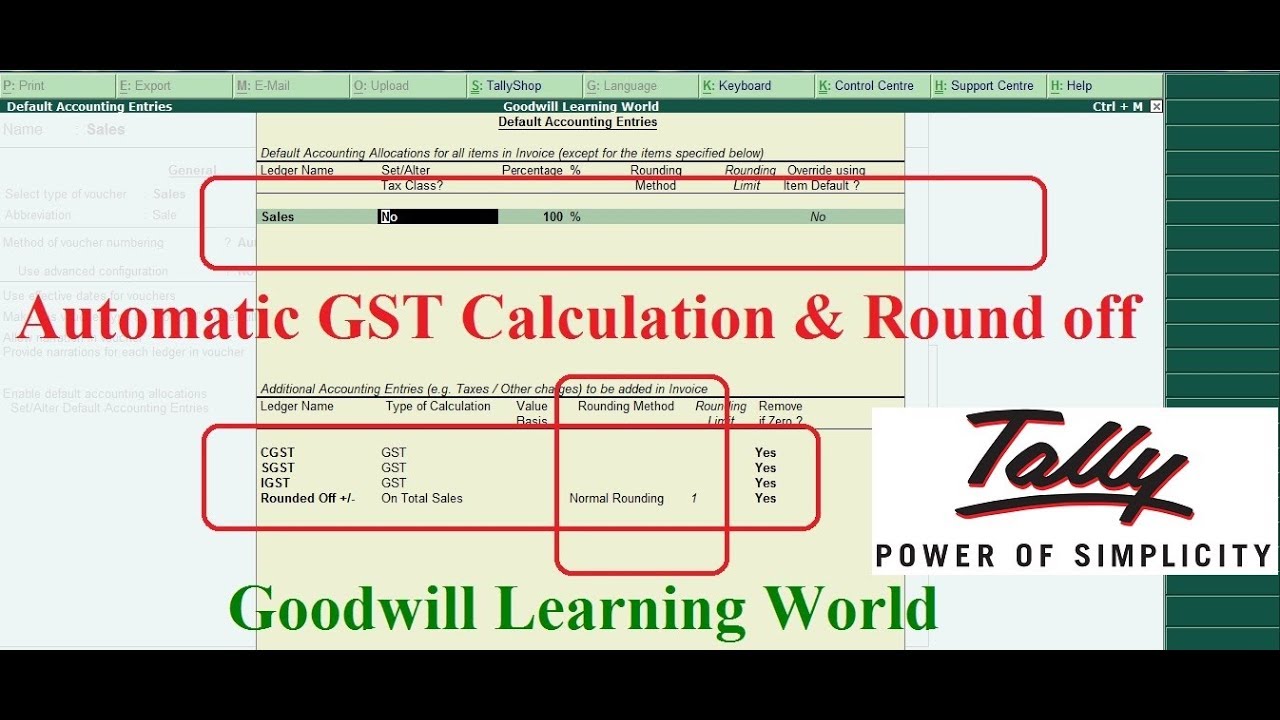

Tally Advance Configuration Auto Round Off And Auto Gst Calculation In Tally