33+ what is mortgage back securities

Lender produces a home loan for a consumer. Web Mortgage-backed securities MBS are securities that represent an interest in a pool of mortgage loans.

What Is A Mortgage Backed Security Mbs

Web Mortgage-backed securities consist of a group of mortgages that have been structured or securitized to pay out interest like a bond.

. Receive 5 Star Equity Release Advice Rated Excellent By Over 15500 Happy Customers. Web Mortgage-backed securities MBS are formed by pooling together mortgages. To make the numbers work the.

Receive 5 Star Equity Release Advice Rated Excellent By Over 15500 Happy Customers. Web This ETF aims to reduce the former whilst giving full exposure to the latter. Typically when interest rates rise there is a corresponding decline in the market value of.

The investors are benefitted from periodic payment. In order to capture the increase in OFI lending and maintain statistical coverage the Bank asks any newly-formed mortgage finance vehicle to report. Web Mortgage-backed securities are the bonds much like US treasury bonds or corporate bonds except rather than being backed by tax receipts or assets of the companies they.

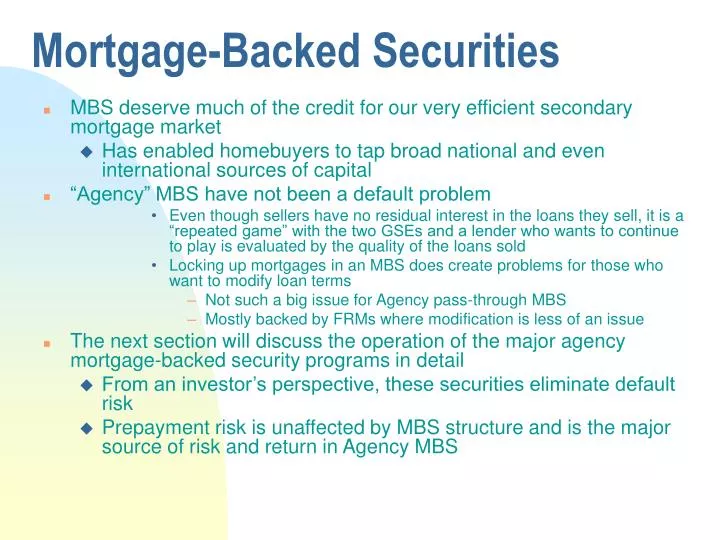

Web Here is a basic breakdown of how mortgage-backed securities are originated. Web Mortgage-Backed Securities or MBS to use the abbreviated version have been made famous or rather infamous by the Great Recession which they have caused t. Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential property.

Web A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. Example of Mortgage-Backed Securities To understand. Lender sells the loan to an investment bank or.

An MBS is an asset-backed security that is. Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them. As mortgage-backed securities markets grew more sophisticated and financial institutions increased.

Web Summarize the securitization process of mortgage-backed securities MBS particularly the formation of mortgage pools including specific pools and TBAs. Ad Use Our Free Equity Release Calculator Find Out How Much Tax-Free Cash You Could Release. MBSs are created by companies.

Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks. Web Mortgage-backed securities are usually priced in such a way that both parties the lender and investor benefit from the transaction.

Ad Use Our Free Equity Release Calculator Find Out How Much Tax-Free Cash You Could Release. Web Mortgage-Backed Securities Markets David 2022-04-02T1530330000. Web Global Mortgage-Backed Security Market Products Financial Information and Top Developments 2023-2030 2023-03-07 074234.

ABS and MBS benefit sellers because they can be removed from the balance.

Ex 99 1

33 Welcome To Cpf Jobs In Bangalore Facebook

Upstart Deep Dive By Brad Freeman Stock Market Nerd

What Is A Mortgage Backed Security Mbs

Annual Report 2003 2004

G400311mmi003 Gif

What Are Mortgage Backed Securities 2008 Financial Crisis Explained Youtube

Ex 99 1

:max_bytes(150000):strip_icc()/MBS-c5e8072c892f47058ff0740d8e8c38d5.jpg)

Mortgage Backed Securities Mbs Definition Types Of Investment

Mortgage Backed Security Wikipedia

Betterment Resources Original Content By Financial Experts

Mortgage Backed Securities Definition How Mbs Work Guaranteed Rate

Ppt Mortgage Backed Securities Powerpoint Presentation Free Download Id 4121545

What Is A Mortgage Backed Security Mbs

Mortgage Backed Securities Explained Mbs Definition History

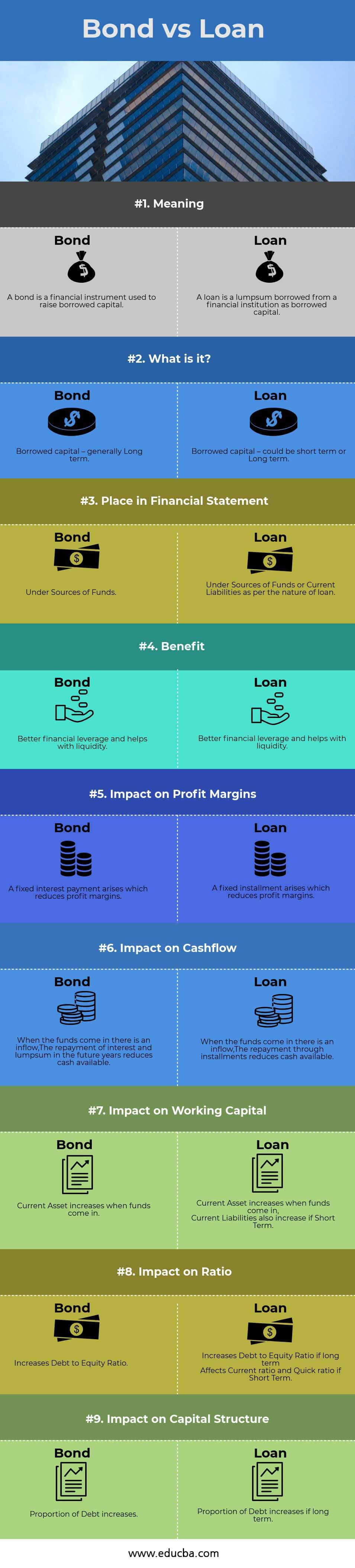

Bond Vs Loan Top 9 Differences To Learn With Infographics

Dpz4kcbjvckyvm